“Stand on the Shoulders of Giants!“

The investment portfolio of Berkshire Hathaway, led by Warren Buffett, is a major point of interest for investors worldwide. Whenever Berkshire Hathaway buys or sells large amounts of specific stocks, it makes headlines and becomes a hot topic among investors. But how can we know the current holdings of Warren Buffett? The answer lies in the 13F filings in the United States. These filings allow us to see not only Warren Buffett’s portfolio but also those of other Wall Street legends. In this post, we will explain what 13F filings are and how to use them effectively.

What is a 13F Filing?

A 13F filing is a quarterly report that institutional investment managers with over $100 million in assets under management are required to submit to the U.S. Securities and Exchange Commission (SEC). The formal name is “Form 13F,” but it is commonly referred to simply as “13F.” Introduced by the SEC in 1975, the main goal of this filing is to promote transparency in the investment market by disclosing the holdings of large institutional investors.

A 13F filing details the stocks held by an investment institution at the end of the quarter, including the number of shares, the percentage of ownership, and the total value. This information allows investors to see which stocks these institutions are investing in and how their portfolios are structured.

Benefits for Individual Investors

For individual investors, 13F filings are invaluable for building investment strategies. By examining the investment ideas of Wall Street legends who manage substantial funds, one can gain insights into market trends. For example, the portfolios of Warren Buffett’s Berkshire Hathaway, Bill Ackman’s Pershing Square Capital, and Baillie Gifford, which has achieved over 8000% returns from long-term investments in Tesla, are all accessible through 13F filings.

However, it’s important to note that 13F filings are published up to 45 days after the end of each quarter. This means the data is not real-time, and the actual portfolio might have changed by the time the filing is made public.

How to Access and Use 13F Filings

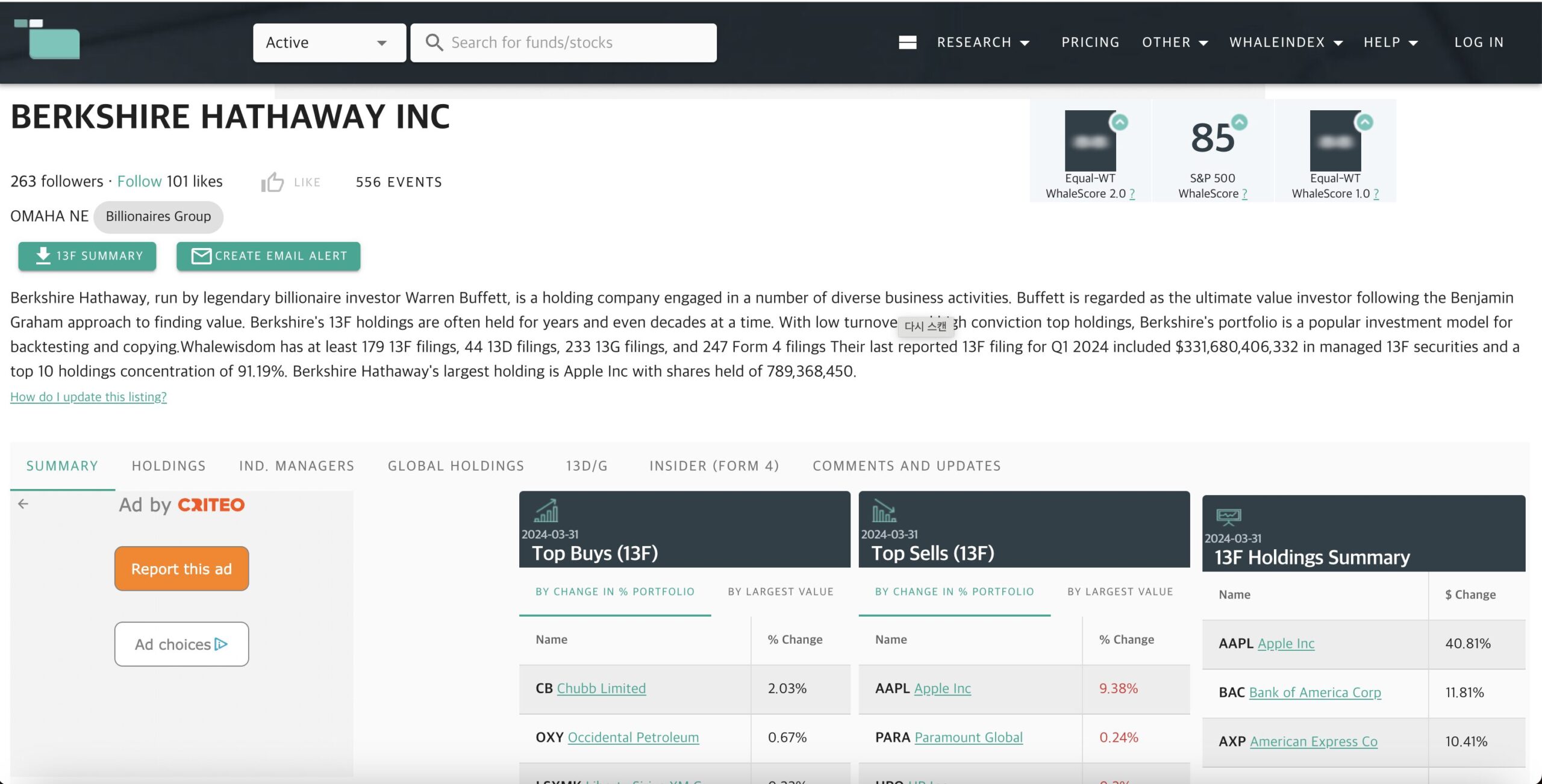

The primary source for 13F filings is the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system, akin to South Korea’s DART (Data Analysis, Retrieval, and Transfer System). However, the format can be complex and unfamiliar to individual investors. Many investors prefer to use user-friendly websites like WhaleWisdom (whalewisdom.com), which organize and present 13F data in an accessible way.

Key Ways to Use 13F Filings

- Gaining Market Insights: By reviewing the buy/sell activities and holdings of various companies, investors can gain insights into the macroeconomic perspectives of leading investors. 13F filings show changes in portfolio composition from the previous quarter, highlighting which stocks have the highest ownership percentages, changes in the stock and bond allocations, and new acquisitions. This helps investors infer the economic outlook from the actions of top investors.

- Evaluating Specific Stocks: On WhaleWisdom, searching for a particular stock reveals detailed information, such as which institutions hold the most shares, the percentage of total shares they own, changes in holdings compared to the previous quarter, and the initial purchase dates. This is akin to receiving advice from top U.S. investors about specific stocks. Thus, 13F filings serve as excellent resources for evaluating and strategizing around stock investments.

Caveats When Using 13F Filings

It’s crucial to remember that 13F filings can be up to 45 days old. Many investment firms submit these filings as late as possible to avoid revealing their strategies to competitors, which means the portfolio details might not be current. This is especially true for firms engaged in short-term trading.

Additionally, 13F filings only cover U.S.-listed stocks, ETFs, ADRs, convertible bonds, and options (13F Securities). They do not include stocks listed in other countries, bonds, or options outside the U.S. Furthermore, the filings don’t explain the purpose of each investment. An institution might invest in a stock for its growth potential or as a hedge against other risks.

Therefore, 13F filings should be used as a reference rather than a guide for blind imitation. While it’s beneficial to align with the strategies of professional investment institutions, relying too heavily on a single portfolio is unwise. Instead, observing common trends across various institutions can provide more reliable sector outlooks and trends.

Conclusion

By understanding a few key points, 13F filings can be incredibly useful for observing the movements of top investors worldwide. As the old saying goes, “Stand on the shoulders of giants.” By wisely leveraging 13F filings, you can enhance your investment strategy and improve your investment returns.